After six years at Amazon, it’s finally time to move on and try out early retirement.

As a few folks have guessed, we’ve been proponents of the FIRE movement for a long time now. I am not in a position to give anyone else financial advice and your circumstances are certainly unique to you, but here are some of the resources we used along the way. (Note: where possible I’ve given you a referral link as we both get a benefit.)

- Get Rich Slowly – JD Roth has written a lot of excellent posts and articles about personal finance. One that I found really helpful was on the Balanced Money Formula, and we’ve been using the Needs/Wants/Savings categories for our spending since 2013. We’ve tweaked it a bit over the years, but it’s a good high-level framework to get you going.

- Mr. Money Mustache – A more fun (and sweary!) look at financial independence, this blog has given us a lot of ideas and inspiration over the years.

- J L Collins – Pretty much the godfather of the FIRE movement. He gave a talk at Google one year that Rodd found really helpful, and his site has a lot of useful resources.

- Reddit – Rodd’s recommendations in particular are r/Bogleheads, r/ChubbyFIRE, r/EuropeFIRE, r/ExpatFIRE, r/fiaustralia, and r/financialindependence. He notes: “r/ChubbyFIRE is for people targeting a particular range of retirement spending. There’s FatFIRE for the >$10M crowd (“Is NetJets worth it, or should I just fly first class?”). Also LeanFIRE for people happy to eat rice and beans for life if it means not working.”

- You Need a Budget (YNAB) – I’ve written about this budgeting app in the past, and we’ve been using it for 10 years now. It’s mostly geared towards people getting out of debt (using the envelope system), but it also has really good tracking and reporting tools. It has both Android and iOS apps, and you can have separate budgets in other currencies (which we made use of in Germany). In some countries it can pull in your bank transactions automatically, but Aussie banks aren’t supported so we manually put them in every week.

- Sharesight – We use this online portfolio manager to track all our different investments. Rodd says it’s particularly useful when it comes time to prep our tax returns.

- Google Drive – Before we landed on YNAB, we had a shared spreadsheet that broke down our income, spending (Needs and Wants), and savings every month. This means we have our spending data all the way back to 2010. We also have a spreadsheet that covers all of our different accounts and investments. (Rodd doesn’t like how Sharesight handles cash/savings accounts, so he prefers to consolidate them here.) We also have a shared folder where we put all our payslips and tax-related docs every year.

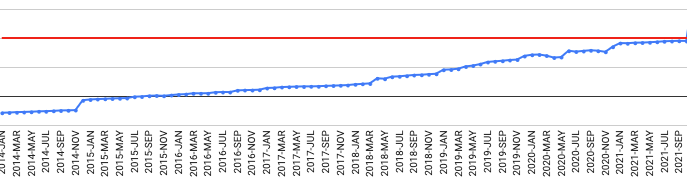

A lot of retirement planning is based on your income. We realised quickly that that’s silly; we needed to set our goals on what we wanted to spend. By tracking our spending over time, we had a pretty good idea of what we needed each month. Then we could work out a target that made sense, and put all our efforts into hitting that. Our Google spreadsheet had a graph that tracked our net worth vs. that goal, and it gave me such satisfaction to see the little line marching up every month. Both of us were lucky enough to receive stock from our employers, which we sold as soon as it vested and put into low-fee mutual funds and other long-term investments (spread across US, EU, and AU to reduce risk).

In truth that red line is a little bit of a lie, because we hadn’t accounted for lifestyle inflation and a few other things. It was a good motivational symbol though. It became clear a couple years ago that we had the option to stop work if we wanted to, and in 2022 Rodd opted for it. He’s been out for nearly two years and is really happy. He managed our move back to Australia, got a part-time job leading craft beer tours, organised the renovation, and has managed the household and our lives to free me up to focus just on work. I’m a bit more anxious, so I kept going to pad things out a bit more and cover the cost of our renovation. By the beginning of this year, I was starting to feel really tired and ready to stop. I love my team and my job, but the pandemic really prompted me to think about what’s important. My values have changed. I want to slow down; to focus on my creative pursuits; and to get healthy. So a few months back I told my manager that I was done, and the time to say goodbye finally arrived.

I am not naive enough to think this is possible for everyone. It involved a huge amount of luck and privilege. While we both needed loans for college, we graduated at a time before tuition costs skyrocketed. We are extremely fortunate to have landed in our particular careers at this particular time in history. Between us we had 40+ years in the tech industry, nearly half of it at some of the biggest companies in the world. We were also incredibly lucky to buy a house for a decent price in a neighbourhood where we don’t need to have a car. We don’t have kids, and we live in a country with strong national healthcare. We haven’t had to deal with relationship breakdown or serious illness. And despite me saying “we” throughout this post, most of the long-term investment efforts have been managed by Rodd. I’m incredibly lucky to have a partner that is interested and capable of navigating this stuff. Obviously we can’t know what will happen in the future, and I’m not ruling out getting a job again at some point. But right now I’m excited to have our time be our own, and to enjoy life for a while. I’m looking forwad to catching up with friends, and to moving back into our house once it’s finished. We’re also exploring options for volunteering, to start to pay it forwards for others.

And of course… expect a lot more blogging! I can’t wait to get back to it. ❤️