Photo by Annette Fischer on Unsplash

It’s the end of the year, which means the Snook and I have both been diving deep into our financial accounts for 2020. While we have combined finances, I tend to track the month-to-month micro expenses and budget while he looks after the long-term retirement planning and investments. (If you’re interested in how we track everything, there’s a bit at the end of this post.) We’ve also now been in Germany for four months, which means we can start to get a comparison for the cost of living here vs. in Australia. I figured some of you are probably curious about how it works out. (All amounts below have been converted to AUD for comparison’s sake.)

The tl;dr: We didn’t move here to make money. While our income is roughly the same, the cost of living is higher (especially as we’ve gone from a house we own outright to one that we are renting). We are also paying a lot more in taxes, and for health insurance. That said, we don’t have kids; we don’t have cars; and we were already saving a lot of our income. We’re just not saving quite as much as we would’ve been otherwise. So why do it? For a new experience and adventure, and getting to travel all around Europe. While we’ve definitely been enjoying the experience, Covid has rather put a damper on the travel. I’m optimistic for 2021 though… 🤞

Income: In terms of salaries, both of our companies made us offers in line with the going rate in Munich. For the Snook, that worked out to a slight pay increase from Sydney. For me, it was a slight decrease. (However, I changed job families at the same time so I’m not sure whether that would have been the case if I’d stayed in the same role.) We kept our existing stock grants. We also received relocation grants to offset the cost of packing up our lives and moving halfway around the world, and given that we did a lot of that work ourselves, we were able to save some of that.

Accommodation: Based on quick search of comparable units in Sydney, we are paying 1.3x that for our place in Germany (including rent, utilities, and Internet). However, the apartment we’re renting is fully furnished, centrally located, and bigger than our place in Sydney. We could definitely save money by getting a smaller place farther away from the city center, but we made a conscious decision that the expense was worth it (especially as we are under Covid lockdown and working from home). We are also renting out our house back in Sydney, which helps to offset some of the added expense.

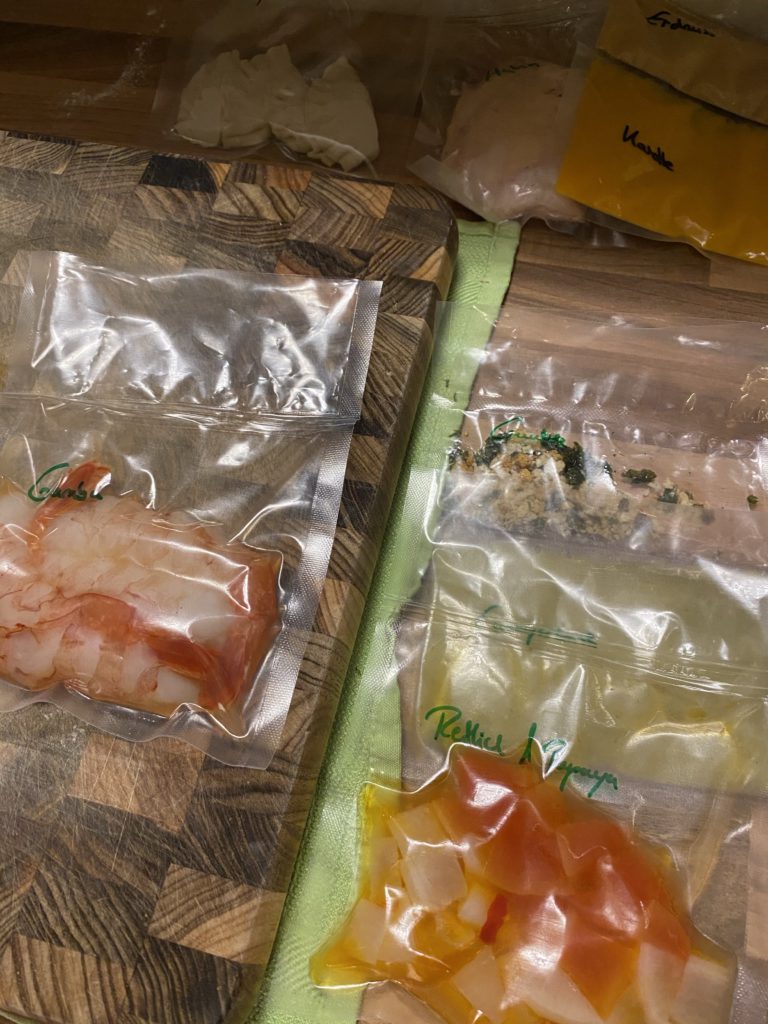

Groceries: I did a comparison of January to August 2020 (living in Sydney) against September to December 2020 (living in Munich). In Australia, we were spending about $520 AUD per month, and in Germany that’s gone up to $640 AUD. I suspect we cook a lot more than most folks and probably make more elaborate meals, so we were probably already spending a lot by Australian standards. One factor for the increase here is that we aren’t able to buy in bulk the way we were before. That’s partly because we don’t have the storage space (in our pantry or freezer), and partly because the supermarket quantities are just smaller in general here. We also had some added expense here in that we needed to build up our pantry staples (spices, baking ingredients, etc). We definitely eat less red meat here than we did in Oz, and we’ve only had lamb once. (We just found a Turkish grocery though with decently priced lamb, so I expect that will go up a bit!) In both places, we get a veggie box delivered every two weeks.

Health insurance and medical: In Australia we paid the Medicare levy plus a contribution to the Snook’s employer, and we were both covered under their plan. That amounted to about 2.3% of our gross income. The model in Germany is slightly different, in that health insurance is private but mandatory. We are with Techniker Krankenkasse, and the cost is about 4.5% of our income. That includes a special surcharge because we don’t have children (presumably because we’ll be a bigger drain on the system someday! 😳). That said, there are different options here and we suspect we’re paying at the top end, so we may end up switching to something cheaper in the future. I’ve also got no idea how much optical/dental is covered, so that may affect it as well. I stocked up on contact lenses before I left Australia, but I need to find us a German dentist…

In terms of medical expenses, it’s too early to tell really. We’ve both had initial check-ups with a GP here, and while the appointments were free, we paid out-of-pocket for a few different tests and treatments. (For example, my blood test didn’t show evidence of my last measles vaccination, so I paid to get one. We’re also both now on Vitamin D supplements.) As far as I can tell, basically no drugs are sold over the counter here – not even paracetamol! – and you have to speak to a pharmacist for everything. I stocked up my prescriptions before I left Oz, so it remains to be seen what they’ll cost me here. I can tell you that a box of 80 tampons costs €2.80 in the supermarket here, which is about $4.40 AUD. This is massively cheaper than in Australia, where that would only buy you a box of 16 or 20 at most!

Phone and internet: Our internet cost is included in our rent here, but the Snook has done some research and concluded that home internet plans look to be cheaper in Germany. (“What we paid $100 for there, you’d get for like €35 here.”) On the flipside, it looks like mobile plans are way more expensive in Germany. A 40GB plan from Telstra will set you back $55, but the equivalent here is like $95. However, the German plan does include 5G as well as roaming across Europe. (We’re fortunate in that work covers our mobile phones.)

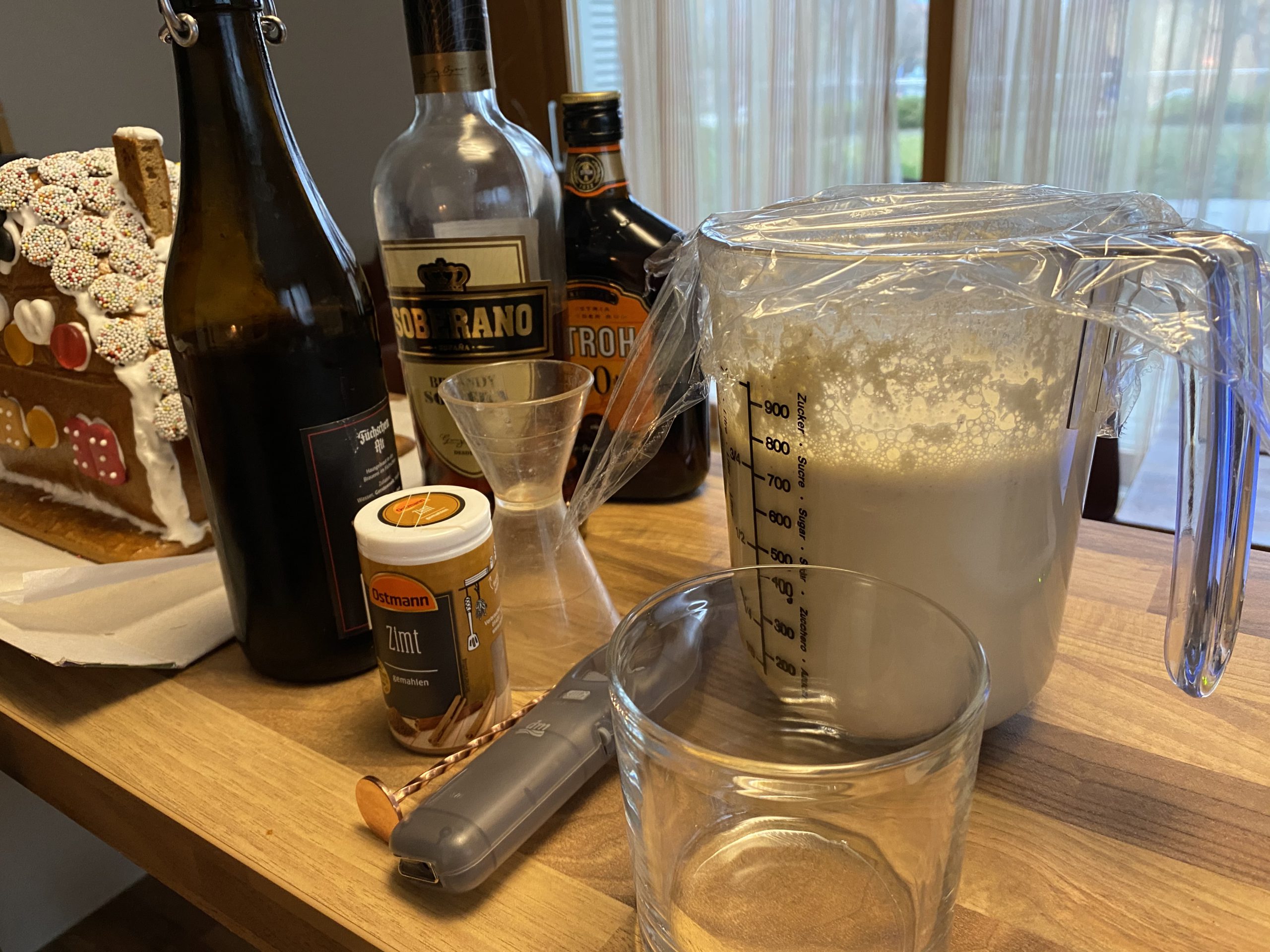

Dining out and booze: This has been such a weird year because of Covid. During April to August in Sydney, we spent around $243/month on dining out or takeaway food, and $158/month on booze. In Germany, it’s been $265 and $190 respectively. I’m actually a bit mystified by the dining amounts, as I don’t feel like we’ve gone out or had delivery much at all! I guess the few times we have, we’ve splurged and gone for something nice. Restaurant food is definitely more expensive here, but booze in general is cheaper. Most of the booze bill was in building up the cocktail bar supplies, so our actual monthly cost here will be far less.

Grooming: I’ve only managed to have one visit to the salon since I’ve been in Germany, and a colour & cut set me back €125. That works out to just about $200 AUD, which is slightly less than I paid for a visit to my hipster stylist in Newtown. So I reckon it’s going to work out about the same.

Transportation: We’ve barely gone anywhere in the last nine months, but just for the sake of it, let’s pretend we were commuting daily. Back in Sydney, I’d take the bus to and from the CBD to my office and it was $2.24 each way. That’s $22.40 AUD per week. If I were taking a train though, it would be minimum $3.61 each way for a total of $36.10. In Munich, my commute (four stops on the train) would cost me €2.80 each way, which works out to about $44.60 per week. So public transportation is a bit more here. That said, one of the advantages of our apartment is it’s an easy walking/riding distance to both of our offices. If I ride my bike, I can get to the AWS office in about 15 minutes (on a route that is mostly on separated cycleways and completely flat, so a big advantage over Sydney).

How we track everything: For our daily spending, I use YNAB and do a weekly reconciliation of all our accounts. I’ve been using this since 2014, but I’ve actually got monthly spending data for us going back to 2010. (Referral link if you want to sign up.) YNAB is nice because it syncs to our phones and we can record any cash payments instantly. At the end of each month, I have a shared Google spreadsheet that I update with our income, spending (on needs, wants, and charity), net worth, and graphs showing our progress towards retirement. For tracking our retirement and investment accounts, the Snook really likes Sharesight. (Referral link if you want to sign up.) He also has a Google spreadsheet he uses for planning.

Banking: The most pain-free way we could get a bank account here to get paid was through N26, a German neobank. We were able to get free accounts set up in minutes, and they provide a Mastercard debit card as well as Apple & Android Pay. However, we’ve found that some smaller merchants will only accept girocard, which you can only get through one of the traditional banks. So we’ll probably end up setting up a joint account at one of those eventually. We also set up Transferwise accounts before we left Australia, which make it easier if we need to send money back and forth.

Tax services: Ugh, don’t even ask. I’m going to end up filing in three different countries next year! Fortunately our employers pay for a tax agent to assist for the first year, but after that we’ll be on our own. Yeah, it’s going to suck.

I hope that answers some of your questions! Let me know if you want any more info and I’ll share what I can.