This is a write-up of a talk I gave at the October 24, 2024 meetup of Sydney Technology Leaders. While it wasn’t recorded so this isn’t an exact transcription, I’ve written out my notes and the information I gave as best I can remember. It also builds on and expands a previous blog post I wrote, so you may want to check that out too.

For those that don’t know me, I’m a dual American-Australian citizen. I’m 47 years old, and I’m a DINK—double income, no kids. I’ve worked in the Sydney technology industry in a variety of roles for more than twenty years, but I haven’t worked a day in the last 3 months. It’s been glorious.

Before I get to the HOW, I want to first acknowledge that this is a pretty awkward thing to talk about. I’m very, very lucky. Everyone in the room tonight—unless you were digging ditches today—is very lucky. We live in a country with national healthcare, and you don’t have to worry about your kids being shot at school. We earn good wages. We are at a social gathering, eating free food and drinking free booze. The older folks in this room came of age with the Internet, and we were lucky enough to get in on the bottom floor of all of that.

My point here is I don’t want you to think that I think that if you just follow what I did, you’ll have the same outcome. Your circumstances are your own. But I also don’t want you to think that it’s all just dumb luck, and that it’s not worth putting in the effort. My husband and I both come from families of labourers. I was never taught anything about personal finance growing up. I had a part time job from the moment I turned 14 years old. I was the first on both sides of my immediate family to go to university, which I technically only finished paying off in 2020.

My point is that hopefully everybody, no matter their circumstances, can take something practical and useful away from this today.

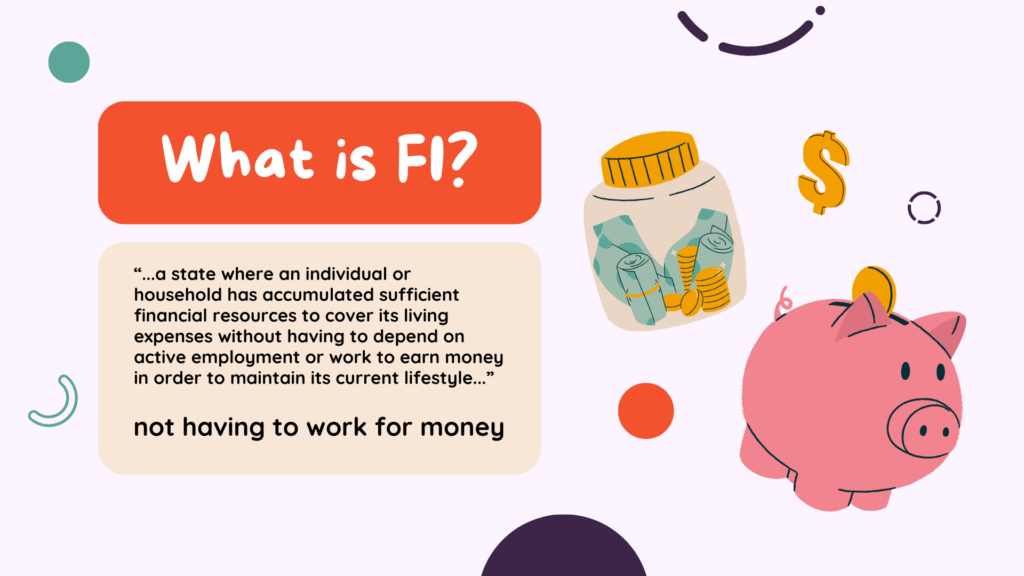

You may have heard about the FIRE movement. That stands for Financial Independence, Retire Early. Let’s park the early retirement for now, as that’s not necessarily a goal for everybody. I want to spend a bit of time focusing on just the FI part—financial independence. I’ve pasted in the Wikipedia definition here, but what it really comes down to is not having to work for money. Imagine if you didn’t need the pay check from your current job. What would that get you?

It would give you agility. (I’ve tried really hard throughout this talk to put things in terms technical folks will understand!) Agility means you can change your priorities up at any time. Maybe you want to start your own business, change industries, or relocate to another country. If you aren’t reliant on that pay check, you can do that. You can even quit your job—tell your boss to eff-off, effectively—at any time, and know that you’ll be okay.

So where does this FI concept come from?

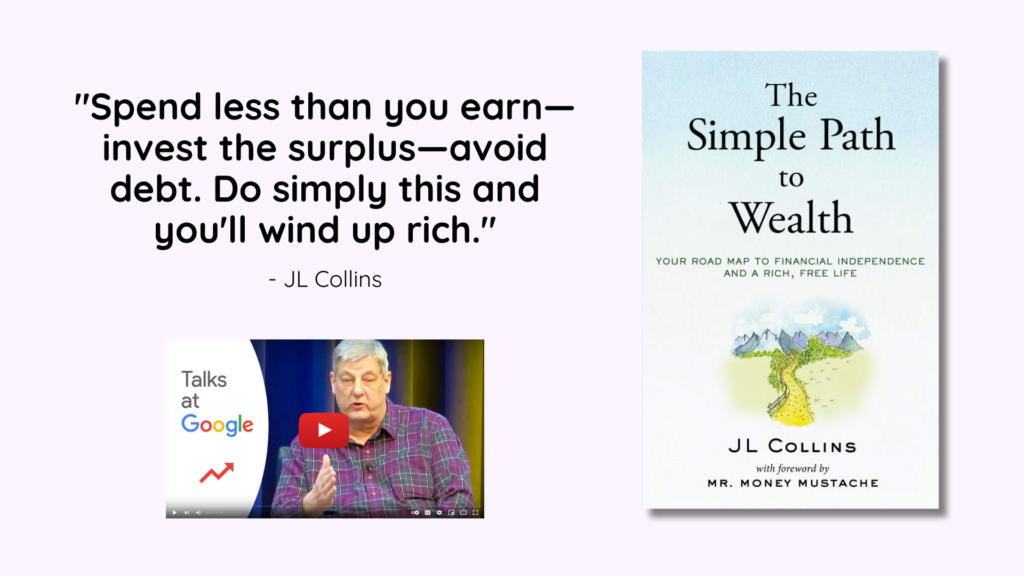

The guy generally acknowledged as the godfather of this movement is JL Collins. His philosophy is pretty simple: “Spend less than you earn—invest the surplus—avoid debt. Do simply this and you’ll wind up rich.” He gave a talk about it at Google that’s up on YouTube, which was how Rodd found out about him. Meanwhile I started reading blogs like Get Rich Slowly and Mr. Money Mustache more than a decade ago.

So in practical terms—how do you make FI happen?

First there’s one more caveat: this talk is based on the assumption that we live in a capitalist society. Earning, spending, and investing money involves political and ethical considerations. Every one of us has their own moral Rubicon that they won’t cross, and I completely respect that. (You are not going to hear one goddamn word from me about crypto in this talk, for instance.) But if you see all property as theft and want to dismantle the system, good for you. I will 100% sign your petition and support your right to protest. But me, I like living in a nice house and buying a new computer every couple of years and going on the occasional vacation. I accept that if and when the revolution comes, I’m going to be fairly far towards the front of the queue for the firing squad. For now, I can live with my choices.

So the four steps I’ve outlined here are Tracking, Budgeting, Investing, and then possibly Retirement.

Let’s start with Tracking. How much do you spend on groceries every year? How about electricity? Dining out at restaurants? Buying clothes? You probably have a rough idea – but do you have DATA?

For each of the steps, I’ve compared them to an analogous AWS Well-Architected pillar. For Tracking, I’ve gone with Operational Excellence because it’s all about monitoring your running systems and processes, and defining standards for your daily operations.

Way back in 2007 Rodd and I started to think about buying a house, and we used a mortgage broker to help us work out what we could afford. We didn’t have a lot of financial discipline, but we got very lucky and found a place that wasn’t beyond our means. We knew we needed to get a better handle on where our money was actually going. And like good nerds, we looked to technology for a solution.

Really what we wanted was to build a data lake by logging our spending. We also wanted to create dashboards and reports to get visibility on where our money was going, and to help make things easier at tax time. We tried out a few different apps along the way, as well as shared Google spreadsheets to bring things together. Nowadays many banks allow you to categorise transactions, but you might have multiple accounts. So for us, having a standalone app was important, and we needed one that works for both iOS and Android. We considered automation for pulling in bank transactions but ultimately decided that the exercise and discipline of manually entering transactions would be good for us, and it only takes 15-20min a week.

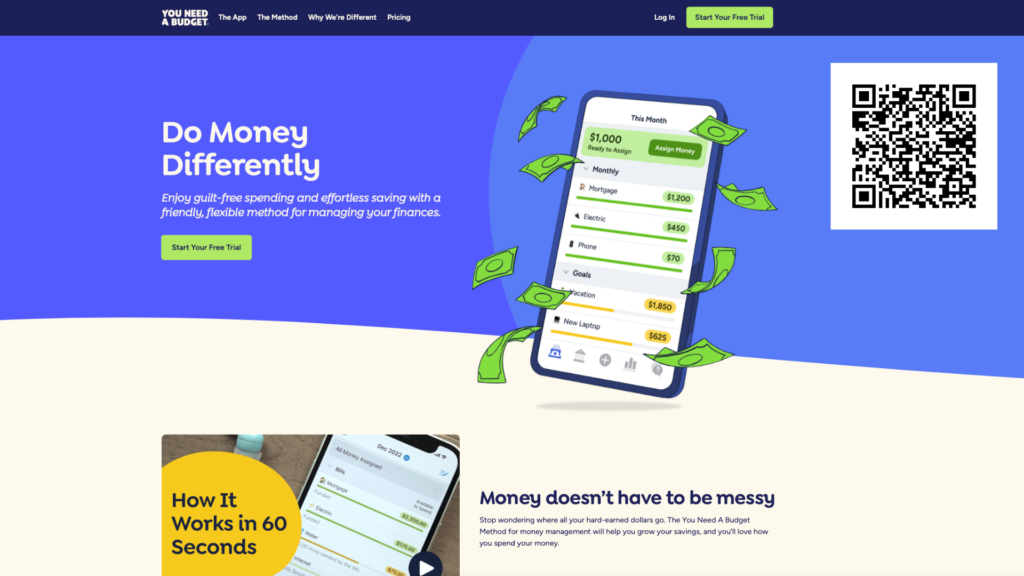

Ultimately the solution we went with is You Need a Budget and we’ve been using it for more than a decade. They have a blog and YouTube channel where they shared a lot of content around financial education and getting out of debt. It does cost money though, but we’ve found it to be well worth it. I’ve included a referral link if you want to get a free trial.

This is how I know exactly how much money we’ve spent on groceries each month. It’s really easy to create reports or search through the logs to see what you’re spending. (Note: I showed the real graphs during the talk, but for the blog I’ve blurred out the actual numbers for privacy.)

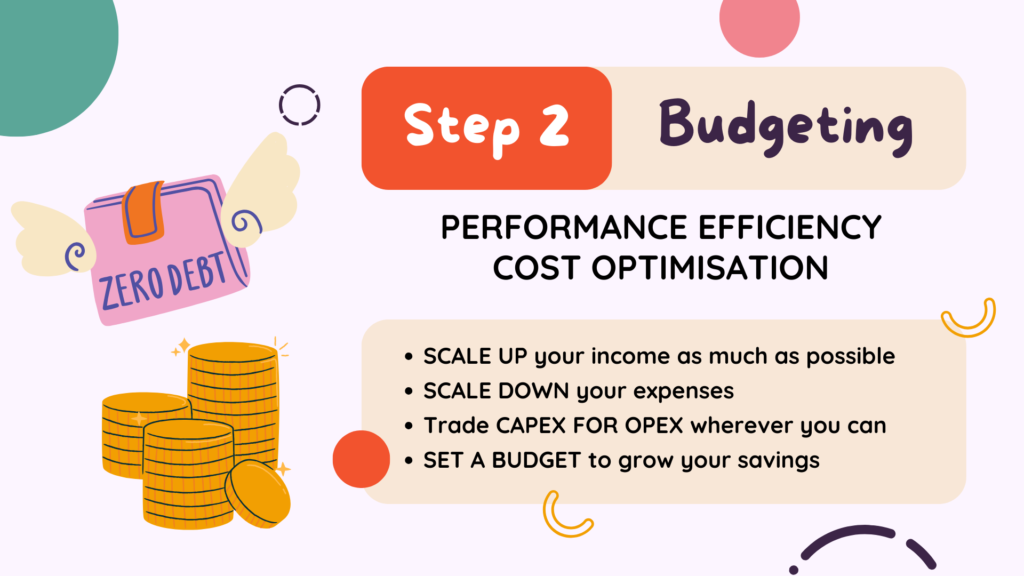

Once you get some data and visibility on where your money is actually going, it’s time to actually get insights from it. What targets should you be aiming for? What do you need to increase or reduce? That’s where Budgeting comes in.

The Budgeting step is analogous to Performance Efficiency and Cost Optimisation. It’s all about making sure that everything is right-sized and cost effective.

First and foremost, think about how you can scale up your income as much as possible. Look, maybe you don’t ever want to work for a FAANG company. That’s understandable. But if there’s a way you could double your income NOW—and put that extra money to work—that’s going to make a massive step towards FI. Maybe you could move to a new role, or pick up some on-call shifts.

Next, you want to scale down your expenses. This doesn’t necessarily mean living on lentils, but think about where you could cut things without making a big difference to your life. For us, that means flying Economy class. We cook a lot and make coffee at home. Our pets were rescues. Our furniture has always been IKEA or Facebook Marketplace. We generally subscribe to 2-3 streaming services at a time rather than all of them, and we rotate them around.

I’d also like to suggest trading CAPEX for OPEX wherever you can. This means not buying a thing when you only need it every now and then, but instead just paying for use. We don’t own a car. Instead we’re members of GoGet and we simply rent one whenever we need it. In addition to saving money, it also means we can rent out our carspace and earn some extra cash. (Granted, this is heavily dependent on where you live and whether public transport/car share are available.)

When we started out, we had no idea what our target level of savings should be. Do you know that according to the Australian Bureau of Statistics, personal savings in Australia averaged 9.29% from 1959 until 2024, reaching an all time high of 24.10% in the second quarter of 2020 (because it was Covid lockdown and nobody was going anywhere or spending money). Right now, it’s sitting at 0.6%. Ouch.

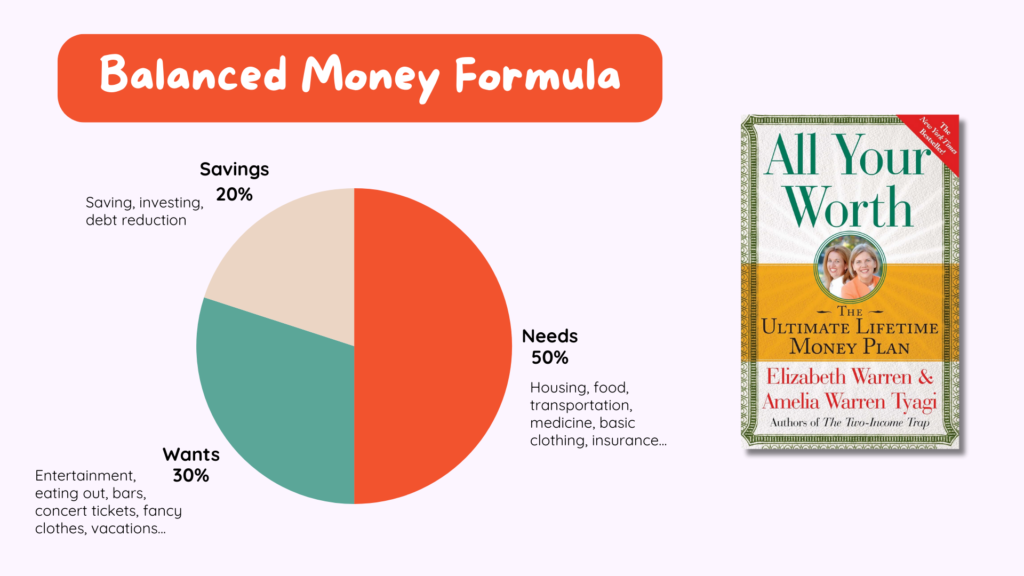

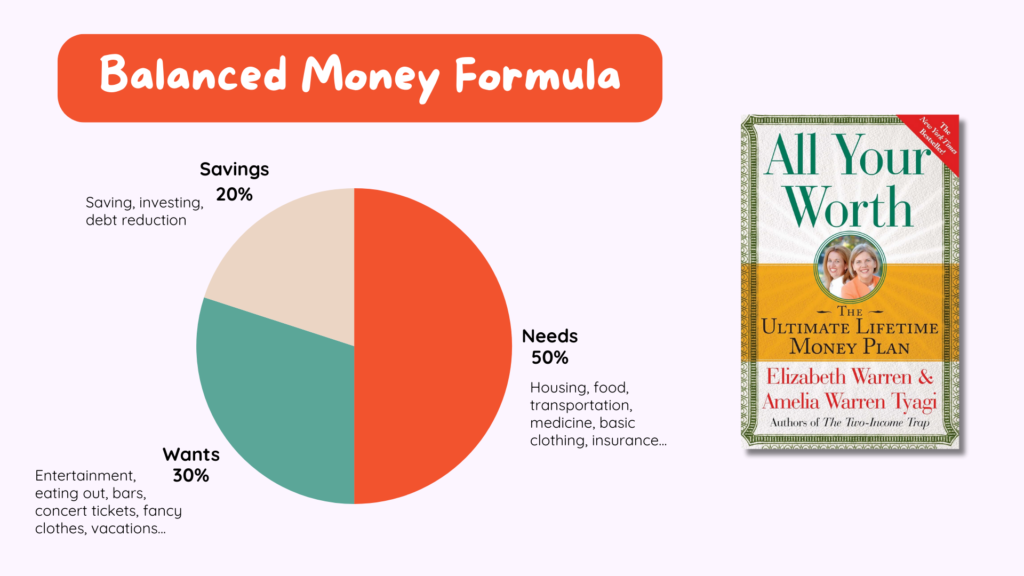

If you’re just starting out, one useful model you can use is the Balanced Money Formula. I learned about this from the Get Rich Slowly blog, but it comes from a book written by Senator Elizabeth Warren and Amelia Warren Tyagi. It’s a simpler alternative to having a really detailed budget. You may also see it referenced as the “50/30/20 rule.” The idea is that no more than 50% of your income (ideally, more like 35%) should go to Needs – these are things you have to have, like housing, food, transportation, medicine, insurance, etc. And you want to save at least 20% of your income, leaving 30% for Wants.

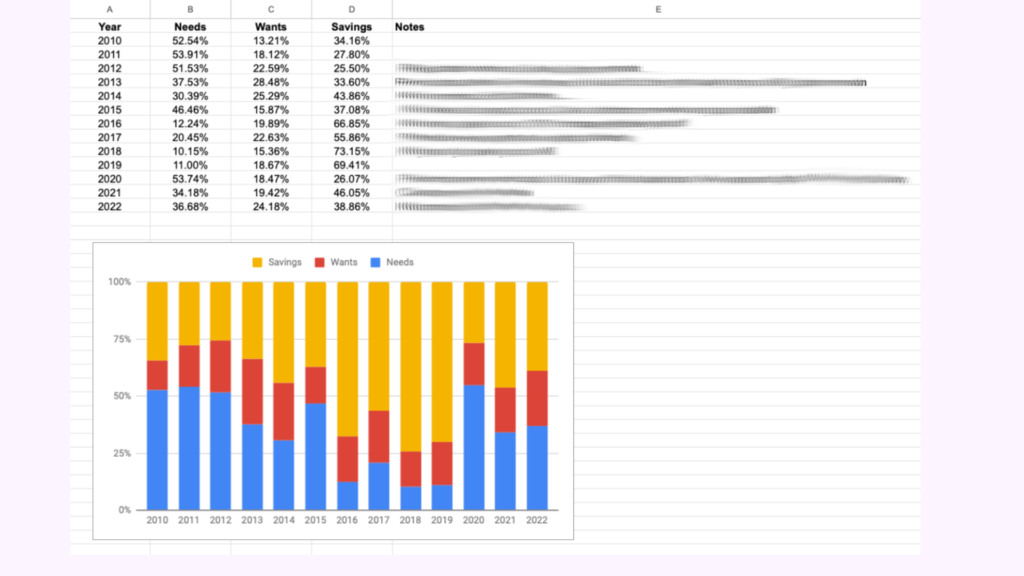

We used YNAB to roll our spending up to these categories and found out that in 2010, we were at 52% Needs, 13% Wants, and 34% Savings. Not bad!

This is a very simple model, but it can be useful to get you going. As a first goal, having at least 3 months of expenses in the bank as an emergency fund is recommended. But this model is about achieving “balance”; it won’t necessarily get you to Financial Independence.

For that, you’re going to need to be more aggressive.

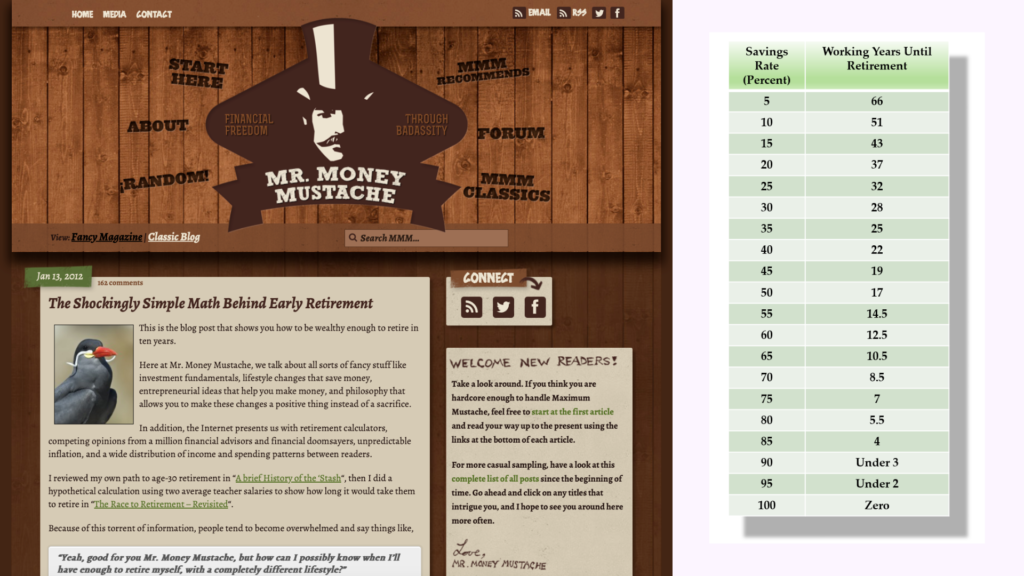

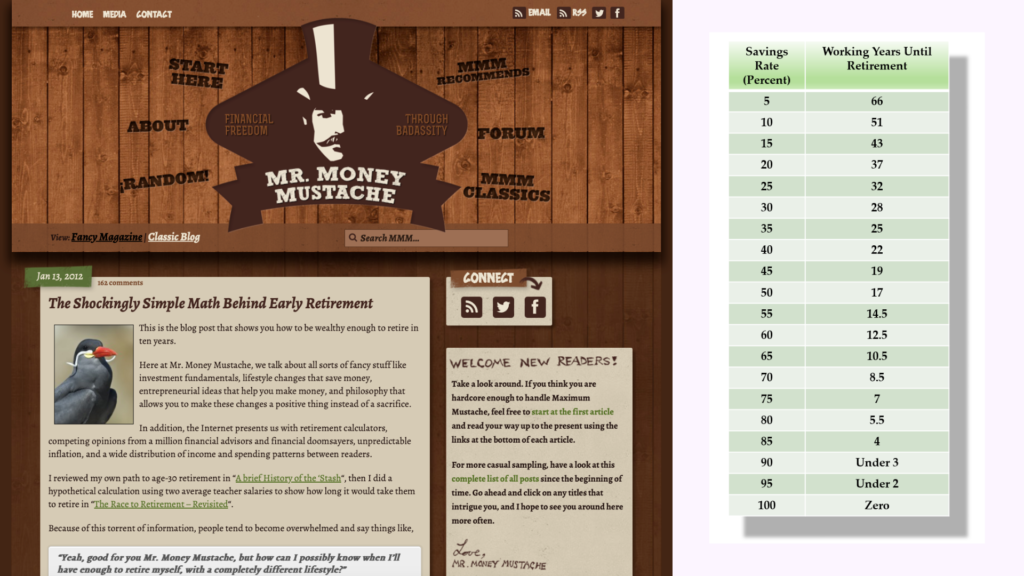

This screenshot is from the Mr. Money Mustache blog and his famous post “The Shockingly Simple Math Behind Early Retirement.” In it he says that your time to reach retirement depends on only one factor: your savings rate, as a percentage of your take-home pay. To illustrate this:

- At 100% spending, you can never retire unless someone else is doing the saving for you (like superannuation or wealthy parents).

- At 0% spending (like someone else is paying all your expenses), you can retire right now.

In between, there’s a graph… but the interesting thing is that it’s not linear. Because once you start investing your money, it starts earning money itself. It snowballs. So the graph ends up curved. This is a long post and I highly recommend you read it, and it includes a chart that I’ve pasted in here. If you want to be really aggressive about FI, Mr. Money Mustache reckons that if you can save 50% of your income, you can achieve FI in 16 years. And in truth, that’s pretty much about how long it took for us.

But you don’t just stick it in the bank in a savings account! You have to put it to work. And that brings us to Investing.

BUT FIRST – A MASSIVE DISCLAIMER.

I am not a financial advisor. Rodd is not a financial advisor. I actually looked it up, and to be a financial advisor in NSW where we live, you have to do a degree and pass a certification. We’ve done neither of those. This is not investment advice. I am simply telling you what we learned from our research, and what we’ve done in our own financial independence journey.

I have likened Investing to the Reliability pillar, because it’s all about ensuring reliability and availability of your future financial resources.

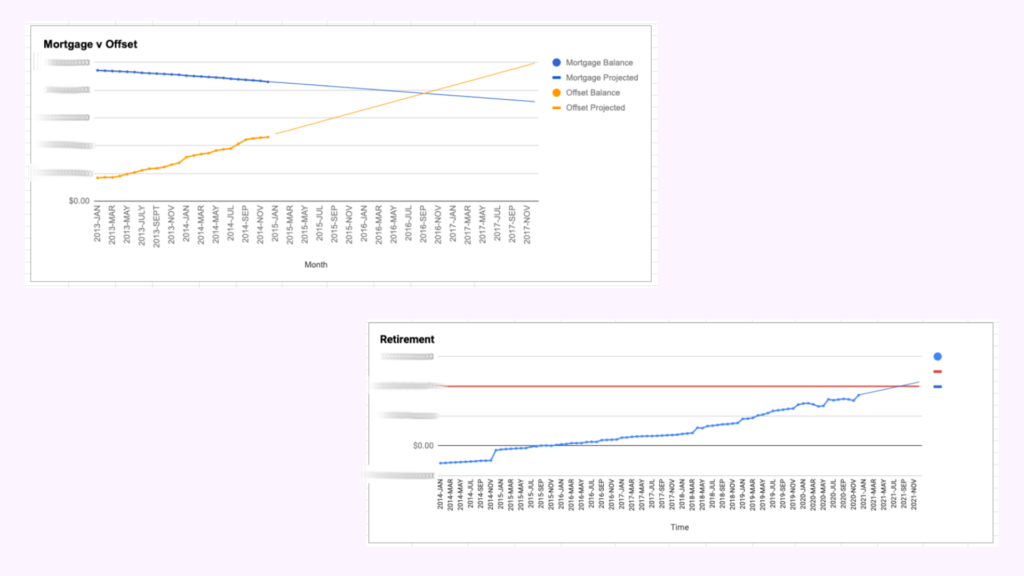

For us, we started by focusing on paying off our mortgage as quickly as possible. We have a Mortgage Offset account and have reached the point where it equals the outstanding balance, and it simply deducts every month. This is a contentious topic in FI circles, because some folks think you’re better off investing that money in something that brings a higher return. We’re fairly risk averse though, and we preferred knowing that we were never at risk of missing a mortgage payment due to a market downturn.

Next, we were fortunate to work for employers that regularly awarded us shares through Employee Share Schemes. I knew a lot of folks at AWS who proudly told me that they had never sold a share. We did the opposite of that. Every time we vested shares, we sold them. The reasoning is simple: if both your current income and your retirement savings are tied up in the same company, what happens if there’s a downturn? You’re at risk of being laid off, as well as your retirement fund value going down. You’ve literally got a single point of failure. Instead we immediately sold the shares and invested them in low-fee index funds, which basically track the performance of the market as a whole. (Historically the stock market has seen 8-10% growth over the past century, on average.)

Because I’m a dual citizen and we have future goals of supporting family in the US, we have also spread our investments across multiple markets. There are also restrictions on what financial instruments Americans can own, so some things are in my name and some are in Rodd’s. We also have interest earning accounts at a few different local banks, ensuring that we’ve got access to cash if one of them has an outage.

And lastly, we are currently looking to engage a fixed-fee financial advisor to look over our plan and see if there’s anywhere we could optimise. (Those cross-border tax gotchas are a real pain for expats.) Many advisors will charge based on a percentage of your assets, and you don’t want that. Look for someone with a set fee instead.

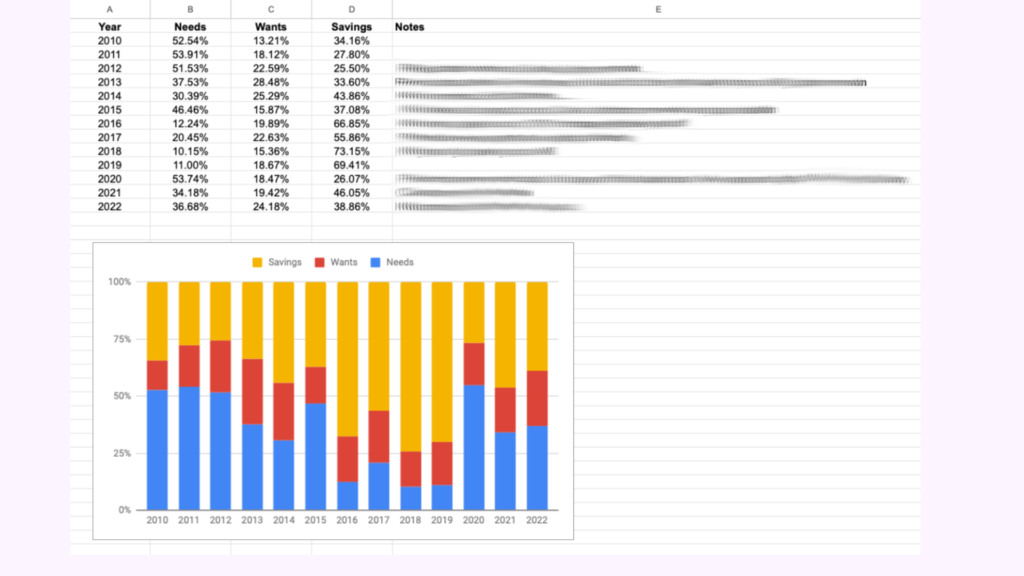

Here’s some historical data showing our breakdown across Needs, Wants, and Savings over the period from 2010-2022 when Rodd retired. What’s interesting to me is that our Wants are fairly consistent, around 20% of our income. There were a few years when it was more, mostly due to renovating our kitchen and garden. The bumper years were 2016-2019, when we saved more than 50% of our income every year (and my income massively increased due to going to AWS). 2020 ended up being one of our lowest savings years, simply because of paying off my final student loans and our relocation to Germany.

You’ll notice this is a Google spreadsheet graph. I created a couple graphs for myself that I found really motivating over the years.

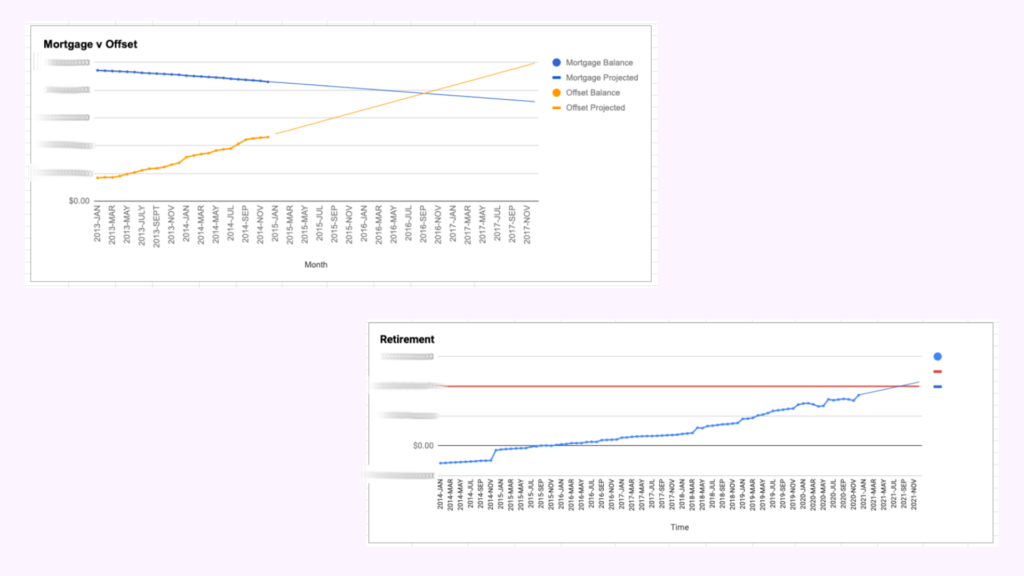

One of them showed the balance in the Mortgage Offset account versus the amount outstanding. In Google Sheets you can extrapolate a trend line, and I loved seeing the intersection in the future and having a date to work towards.

Another was for Retirement. When we started thinking this was maybe a goal, we picked a number that we thought would be a useful target and then I tracked our progress towards it. The goal number turned out to be a little lower than what we needed in reality, but it was a nice round number to aim for. Note: This isn’t your total Net Worth, but rather the value of your income-producing assets. (You don’t get income from your house; you live in it.) So while this graph wasn’t totally accurate, it still showed progress and helped indicate to us when we were getting close to FIRE.

And so at last we come to Retirement, possibly Early depending on how aggressively you’ve been saving.

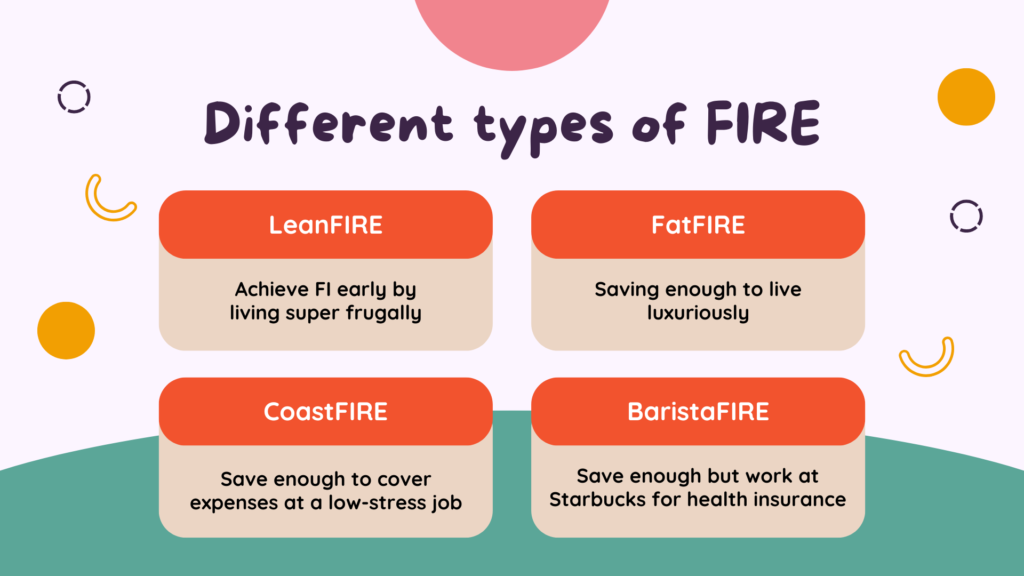

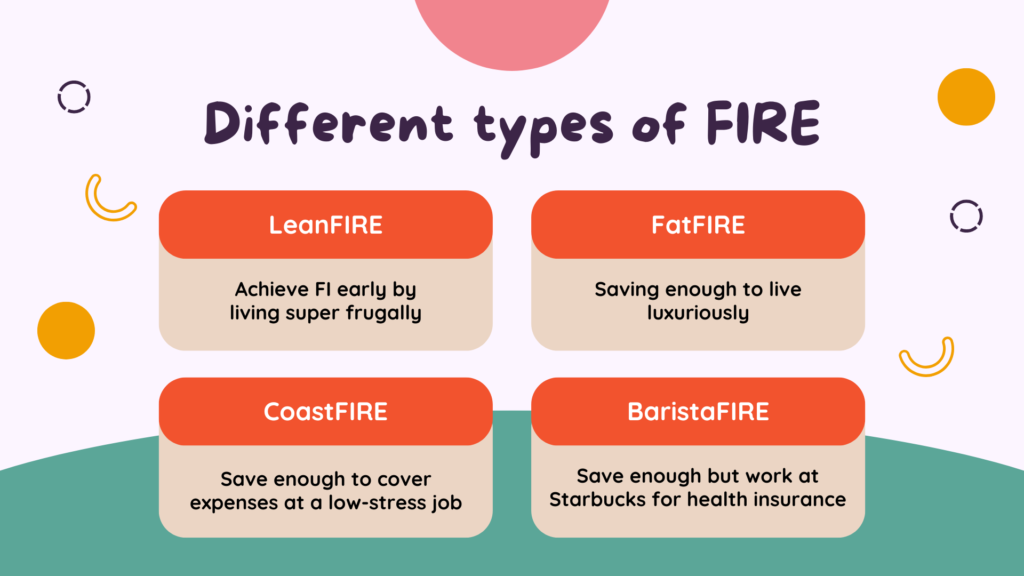

The FIRE movement actually includes many different flavours of FIRE. There’s LeanFIRE, for those who want to cut their expenses to the bone right now in exchange for getting to FI as quickly as possible. These are the folks happily living on lentils now, who are happy to live on lentils forever. Then there’s FatFIRE (and ChubbyFIRE), where the goal is to save enough to be able to live luxuriously in retirement. These are the folks who want to fly Business class always. CoastFIRE is where you’ve saved enough in your retirement accounts that they are snowballing, and they will eventually grow to the target you need for retirement. So you can stop saving now, and switch to a lower-stress, lower-income job that just covers your current expenses. And lastly, there’s BaristaFIRE, where you have saved enough to retire but still work at Starbucks for their health insurance. (This one happens mostly in the US; you don’t need to do that in Australia.)

There are various calculators and spreadsheets that will help you work out what your goal should be for any of these.

Whichever FIRE model you go for, it’s all about ensuring Security of your assets and future lifestyle. The general advice you’ll see on the financial blogs is that you should aim for 25x (25 times) your annual expenses. This assumes a 3-4% drawdown rate over 30 years. This 4% Rule basically ensures that you can draw down a steady income even in the face of inflation and economic downturns. Of course, it’s safest if you can vary your spending. If you go LeanFIRE and you’re retiring on very little income, you don’t have a lot of wiggle room. Whereas in our case, we know that if the market drops, we can cut back on eating out or overseas vacations.

This is also where having a financial advisor can help, because you might have future goals beyond just covering your monthly expenses. Rodd and I have parents who will need support in the future, as well as nieces and nephews we’d like to help out with their education.

In 2022 we realised that we were at a point where retirement was an actual option. Rodd had a good long think about it, and in August 2022 he left Google after his 10 year anniversary there. This photo was taken on his last day. He hasn’t had a full-time job since.

I continued on for 2 more years, with the amazing perk of having my very own househusband. This helped pad out the fund even more, and also covered the cost of the home renovation that we’re doing.

Finally in April this year, I decided that I was burnt out and would join him. I finished up at the end of June and have been retired for nearly 4 months now.

Lastly, here are a few considerations and gotchas you should take into account if you’re thinking about retirement. A big one is that you don’t get work perks anymore! For me, that meant no more company healthcare or mobile phone plans. I had to sign up for my own. It means not being surrounded by free snacks and food at work, if you’re lucky enough to work in an office like that. It means no more branded swag. (Do you know how many AWS t-shirts and jackets I have?!) And the big one—no more racking up frequent flier miles on your employer’s dime. I have my KrisFlyer Gold status for another year, but then I know it’ll probably drop down and I’ll be sad.

There’s also the risk of being bored, and lacking motivation or purpose. Some people love work, and they need that to fuel life. Rodd has been perfectly content in retirement, and he’s found plenty to occupy himself: getting a part-time job as a beer tour guide, volunteering, being on the apartment Strata committee, and organising our renovation. I used to think I would struggle more, being an extrovert, but I feel like the pandemic really changed my values quite a bit. I don’t necessarily feel like I need to be up on stage anymore to feel fulfilled. I have a long list of projects to do at home, and so far I’m enjoying doing them.

You may also experience pushback from family and friends when you tell them you’re retiring. Most folks have been lovely, wishing us well or indicating that they wished they could retire too. But we’ve also run into a couple folks who just could not get their head around it—some come from a culture where you work until you’re 70 to take care of your parents and family. Others don’t understand not wanting to make as much money as possible, forever. They thought we were making a huge mistake. Not much you can do there.

And lastly, retirement shows you how much of the world is organised around work. We flew in from overseas in September and I had to fill out Australia’s Incoming Passenger Card. And right away I hit that field that says Occupation. What do I write there now?! (I went with Consultant. That always feels safe.) Whenever you meet new people, they always ask you what you do for a living. If you register for any tech events, it’ll ask you your company and job title. And of course, it can get awkward when your friends and family have work problems or get laid off. You want to support them but worry that you’ll be annoying or they think you won’t be able to relate.

Just stuff to think about.

Time to sum it all up. I talked about Financial Independence, and how it can give you agility no matter what your ultimate goals are. To get there, you need to first understand your spending. That means you need to start Tracking today, if you aren’t already. Once you’re Tracking you can start Budgeting, and actually being proactive with your hard-earned dollars. We talked about the Balanced Money Formula, and how ultimately FI comes down to saving as much of your income as you can. Once you’ve accumulated some savings, you need to put it to work through Investing in income-producing assets. And ultimately, if you want you can work towards early Retirement, where you can quit your job and live off your retirement savings, assuming you’ve hit your FIRE goals.

Thanks!

I knocked out a quick sewing pattern this week: a new Arkie shirt in some Liberty Tana Lawn I bought in Tokyo back in June. (This is the same pattern I used for the AWS Shirt last December.) I made the biggest size, but it’s fairly roomy and I think I could easily go down a size and still be fine. I think I did a decent job setting in the sleeves, even if I did use a million pins. 😂 I left off the front patch pockets, mostly because I didn’t think they’d add anything and you wouldn’t even see them with the busy print. For buttons, I just used four small pearlescent ones from my stash.

I knocked out a quick sewing pattern this week: a new Arkie shirt in some Liberty Tana Lawn I bought in Tokyo back in June. (This is the same pattern I used for the AWS Shirt last December.) I made the biggest size, but it’s fairly roomy and I think I could easily go down a size and still be fine. I think I did a decent job setting in the sleeves, even if I did use a million pins. 😂 I left off the front patch pockets, mostly because I didn’t think they’d add anything and you wouldn’t even see them with the busy print. For buttons, I just used four small pearlescent ones from my stash.